how are property taxes calculated in fl

Florida property taxes are computed on the taxable value To obtain the taxable value determine the assessed value of the home less eligible. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Real Estate Property Tax Constitutional Tax Collector

Add the value of the land and any improvements to determine the total value.

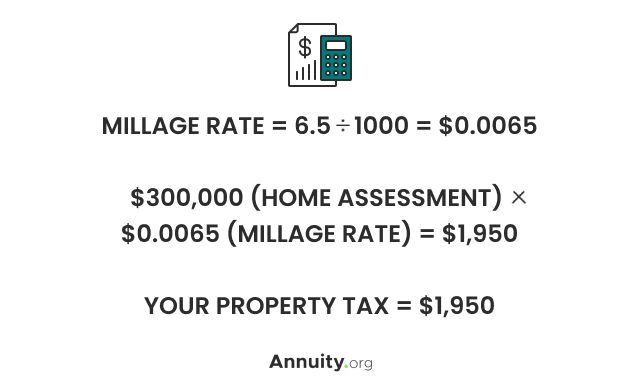

. Property tax rate. Florida imposes a transfer tax on the transfer of real property in Florida. The millage rate is the amount per 1000 11000 of a dollar used to calculate taxes on property.

Taxpayers may choose to pay next years 2019 tangibleproperty taxes quarterly. Real Estate Taxes in Florida and How They Are Calculated Palm Beach County and the Treasure Coast Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes.

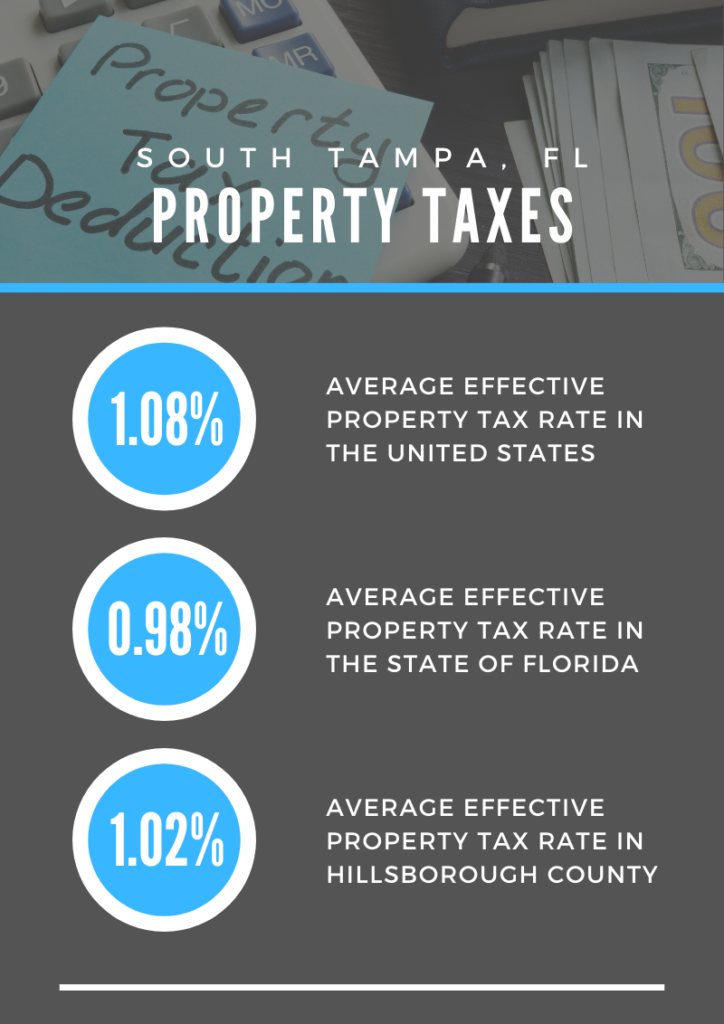

Property tax calculator. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. With each subsequent annual assessment your.

70 per 100 rounded up based on the total purchase price. The expressed millage rate is multiplied by the taxable value of the property to arrive at the property taxes due. Tax rates are calculated by local jurisdictions Determining tax rates.

A mill is one-tenth of one percent. HOW ARE FLORIDA PROPERTY TAXES CALCULATED. When it comes to real estate property taxes are almost always based on the value of the land.

Property tax rates are normally expressed in mills. Calculating South Florida Property Taxes As you create a budget and save up to buy a home in South Florida its important to estimate every cost and fee youll have to pay. Base tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

In its simplest form the real property tax is calculated by multiplying the value of land and buildings by the tax rate. The median property tax on a 21400000 house is 196880 in Manatee County. The taxable value is your assessed value less any exemptions.

Property taxes make up a portion of your monthly mortgage payment and based on the size and condition of your home they may represent anywhere from a few hundred to a few thousand dollars. The median property tax on a 18240000 house is 176928 in Florida. The median property tax on a 21400000 house is 207580 in Florida.

The value of a piece of. The ad valorem taxes are the largest single revenue source of the General Fund. One mil equals 1 for every 1000 of taxable property.

Florida Tax Doc Author. The median property tax on a 21400000 house is 224700 in the United States. How are property taxes calculated in Lee County FL.

The rates are expressed as millages ie the actual rates multiplied by 1000. Generally the property tax rate is expressed as a percentage per 1000 of assessed value. The percentage at which your property is taxed.

Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys taxable value. How to calculate property tax. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

Simply so how are Florida stamp taxes calculated. 69 rows The average Florida homeowner pays 1752 each year in real property taxes. The median property tax on a 18240000 house is 191520 in the United States.

Property taxes in Florida are implemented in millage rates. Florida is ranked number twenty three out of the fifty states in order of the average amount of property. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor.

Tax amount varies by county. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. The total of these two taxes equals your annual property tax amount.

This additional exemption does not apply to school taxes. Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

772 234-0434 Toll Free. 097 of home value. Your property tax is calculated by first determining the taxable value.

For instance if your home is assessed at 190000 and your general property tax rate is 225 then your residences total tax assessment for the tax year would be 4275 225 X 190000100 4275. The City of Naples millage rate is 11500. How are property taxes calculated in Indian River County Florida.

The tax is called documentary stamp tax and is an excise tax on the deed or other instrument transferring the interest in real property. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. Therefore you must add the school taxes back in to the Gross Tax amount approximately 20000.

A local millage rate a dollar amount per 1000 of. The rates are expressed as millages ie the actual rates multiplied by 1000. The results displayed are the estimated yearly taxes for the property using the last certified tax rate without.

Find the assessed value of the property being taxed. The taxing jurisdiction school district municipality county special district develops and adopts a budget. A number of different authorities including counties municipalities school boards and special districts can levy these taxes.

Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000.

Documentary Stamp Tax at. There are a number of factors that come into play when calculating property taxes from your propertys assessed value to the mill levy. Ad valorem taxes are added to the non-ad valorem assessments.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Beginning with the first year after you receive a homestead exemption when you purchase property in Florida an appraiser determines the propertys just value.

Real Estate Taxes City Of Palm Coast Florida

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Florida Property Tax H R Block

Property Taxes Calculating State Differences How To Pay

Property Taxes Calculating State Differences How To Pay

Property Taxes In South Tampa Fl Your South Tampa Home

A Guide To Your Property Tax Bill Alachua County Tax Collector